Individuals inside the workplaces of JP Morgan Chase in New York City City.

Getty Images

A New york city federal judge on Monday ruled that the U.S. Virgin Islands and ladies who implicate the late financier Jeffrey Epstein of sexual assault can continue with claims declaring that JPMorgan Chase purposefully gained from taking part in Epstein’s sex-trafficking plan.

In addition, the j udge enabled parts of a different, comparable claim by Epstein’s accusers versus Deutsche Bank, consisting of the claim that bank likewise purposefully benefited.

The four-page judgment by Manhattan District Judge Jed Rakoff can be found in reaction to movements from JPMorgan and Deutsche Bank to dismiss the 3 suits.

While Rakoff accepted dismiss numerous counts of each of the cases, he enabled the other explosive counts to stay and to head towards trial. The judge composed that he would release a viewpoint discussing the factors for his choices “in due course.”

Epstein, who eliminated himself in a Manhattan prison in 2019 while waiting for trial on federal criminal kid sex-trafficking charges, was a JPMorgan customer from 1998 through 2013.

The last 5 years of that relationship followed he pleaded guilty in Florida to obtaining a minor woman of the street. At a court hearing on Thursday prior to Rakoff, a legal representative for the Virgin Islands stated JPMorgan CEO Jamie Dimon “understood in 2008 that his billionaire customer was a sex trafficker,” a claim contested by a lawyer for the bank.

Deutsche Bank accepted Epstein as a customer in 2013 and kept him as one even after workers reported 40 minor ladies making sexual-assault claims versus him. The bank paid New york city banking regulators a $150 million fine for its negotiations with him.

Brad Edwards, the Edwards Pottinger lawyer who is representing Epstein abuse accusers, called the judgments Monday “ a significant success for the numerous survivors of Jeffrey Epstein’s sex-trafficking plan and survivors of sexual assault in basic, all of whom can rest much easier understanding no specific or organization is above responsibility.”

” Epstein’s sex-trafficking operation was difficult without the support of JPMorgan Chase, and later on Deutsche Bank,” Edwards stated. “And we ensure the general public that we will leave no stone unturned in our mission for justice for the numerous victims who should have much better from among America’s biggest banks.”

In the event versus JPMorgan submitted by a lady taking legal action against on behalf of other Epstein victims, Rakoff sustained the claim that the bank “intentionally gained from taking part in a sex trafficking endeavor” led by its customer Epstein.

The judge likewise stated the accusers might pursue claims that JPMorgan “negligently stopped working to work out affordable care to avoid physical damage,” that the bank stopped working to work out affordable care in offering non-routine banking for Epstein, which the bank blocked enforcement of the Trafficking Victims Security Act.

Rakoff sustained the very same claims in the accusers’ different fit versus Deutsche Bank.

In the Virgin Islands’ match, the judge sustained the federal government’s claim that JPMorgan gained from taking part in Epstein’s sex trafficking, that included shipping females to his personal island in the U.S. area.

The judge dismissed all other claims in the Virgin Islands’ and accusers’ cases.

In a declaration, U.S. Virgin Islands Performing Chief Law Officer Carol Thomas-Jacobs stated, “We are delighted that the U.S. Virgin Islands will continue to work together with survivors to hold JPMorgan Chase responsible for making it possible for Jeffrey Epstein’s abhorrent sex-trafficking endeavor.”

” This case is seriously essential to guaranteeing that banks do their tasks, with the comprehensive, real-time details offered to them, as a very first line of defense in recognizing and reporting prospective human trafficking, as the law anticipates,” Thomas-Jacobs stated.

” We anticipate revealing extra realities relating to the depth and reach of JPMorgan’s conduct in the discovery procedure and eventually showing our case in court.”

Patricia Wexler, a spokesperson for JPMorgan, did not talk about Rakoff’s judgment enabling a few of the claims versus the bank to continue towards trial.

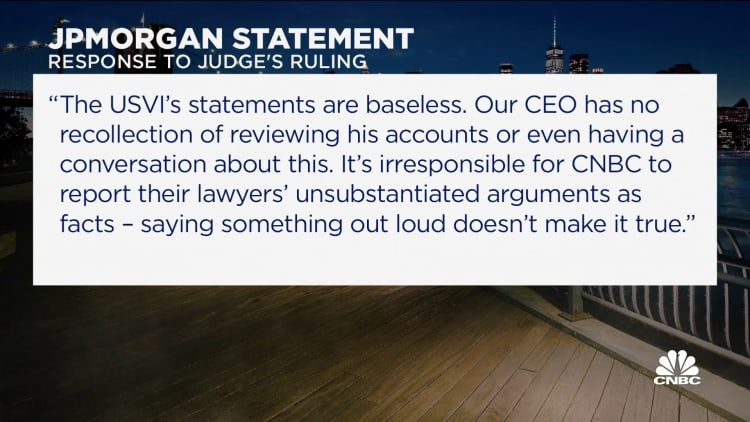

However Wexler hours later on Monday provided a declaration knocking both the U.S. Virgin Islands for making its claims about Dimon and CNBC for reporting them.

” The USVI’s declarations are unwarranted. Our CEO has no recollection of examining [Epstein’s] accounts and even having a discussion about this,” Wexler stated.

” It’s reckless for CNBC to report their attorneys’ unverified arguments as realities– stating something aloud does not make it real.”

A representative for Deutsche Bank decreased to talk about the judgment.

JPMorgan 2 weeks ago took legal action against Jes Staley, its previous financial investment banking chief, declaring that he is lawfully accountable for the suits versus the bank in connection with Epstein.

The bank looks for to claw back more than $80 million it paid Staley, who resigned as Barclays CEO in late 2021 after an examination by British monetary regulators over his relationship with Epstein.

Epstein for many years hobnobbed with star pals who consisted of previous presidents Donald Trump and Costs Clinton and Britain’s Prince Andrew.

— With extra reporting by CNBC’s Eamon J avers