Wall Street saw a solid bounce on Friday, but stocks remains periously close to a bear market.

With a war raging in Europe, surging prices all over and uncertainty over what central banks can do about it, investors may not get that traditional lazy, hazy summer.

Providing our call of the day is the president and chief executive of Stock Traders Daily and portfolio manager at Equity Logic, Thomas H. Kee Jr., who is gearing up for what could be a bullish period for stocks, and says that’s all about understanding volatile days.

Kee said he sees a shift coming, though not one where investors can “buy and hold for the next 10 years.

“This is a market oscillation. In volatile times, markets come down hard and then they go up, they come down and then they go up,” he told MarketWatch in a recent interview. And as markets have dropped hard, stocks are “ripe to come back.”

Kee warned clients of choppy times ahead last December, when the Fed began telegraphing they would be removing stimulus and “the demand fabricated component of the demand variable,” hearkening the return of natural risk perceptions.

“What that means is volatility. In normal market conditions you have volatile conditions,” he said. “It’s not what people are used to because stimulus has been a component since most people have been in the market nowadays, especially all the new [investors].” Pre 2010, markets were naturally volatile, he reminded us.

But as the ECB is still buying aggressively and the Fed hasn’t quite reduced its balance sheet, meaning the fabricated demand is still there, he said.

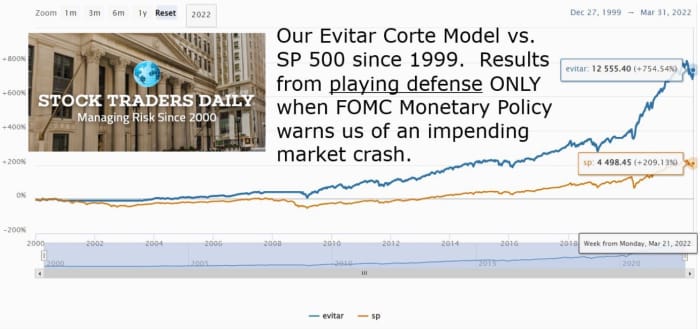

While market volatility has left some investors unsure of what to do and panicky, Kee said he was not seeing signs of an immediate crash risk, based on his proprietary Evitar Corte Model, which uses FOMC monetary policy to define market crash risk.

What should investors do with this info? Kee has long been a fan of index ETF strategies, and suggested investors do the same, only buying or selling index ETFs — he prefers the highly liquid SPDR S&P 500 ETF Trust

SPY,

He cautioned it will take much longer for investors with multiple stocks in their portfolios to control risk.

Since 2000, an investor putting money only in the S&P 500 ETF

SPY,

and cash, moving to cash when his crash indicator was warning of high risk, but all other times investing in the S&P 500 ETF, would be beating the market by 530%, said Kee.

Kee said there are two types of retail investors out there: those who like to trade and those who just want to hold and stay invested. The latter should just focus on being able to neutralize their portfolio and focus on a market crash model that tells them if that’s coming and make it more nimble. The other investor who likes to trade just needs to look at daily or weekly pivot points for the S&P 500.

Stock Traders Daily/Equity Logic

Right now investing in SPY is better than cash, but last December cash was the better investment, he said.

Kee said that their Fibonacci calculator just triggered a buy for the S&P 500 at 3,884. “This calculator is adapted for the stock market, based on mathematical formulas that are governed by human emotion, and without stimulus that is exactly what the market is left with,” he said.

The money manager’s message is clear: “Volatiltiy is here, it’s coming and you better be ready for it and your portfolio better be prepared to handle it as well. Because it’s really difficult for people who have never experienced real volatility to handle volatility,” he said.

Random reads

Tahoe Lake divers strike 25,000 pounds of trash gold

A lemons Swiss and amaretti trifle is about to make British food history

Beyoncé is apparently recession proof

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.