Travel is showing no signs of cooling off this summer, as both demand and prices are expected to stay high.

“There’s still a lot of pent of demand going back to the pandemic,” Booking Holdings CEO Glenn Fogel said on “Squawk on the Street” last week. “They got a lot of savings; they want to spend it.”

Fogel, whose company operates several travel fare aggregators including Booking.com, Priceline.com, and Kayak.com, said the company saw a 26% increase in room nights in January compared to the same month in 2019. He also pointed to the TSA checkpoint travel numbers, which are now within a few percentage points compared to the number of travelers seen in 2019.

That demand has kept prices high, Fogel said, noting recent trips he’s taken.

“I was staying in a hotel in New York City on a Thursday and Friday night, and I said, ‘Wow, that’s a lot of money,'” he said. “I was in Miami earlier in the week, and it’s expensive, but people are willing to spend it.”

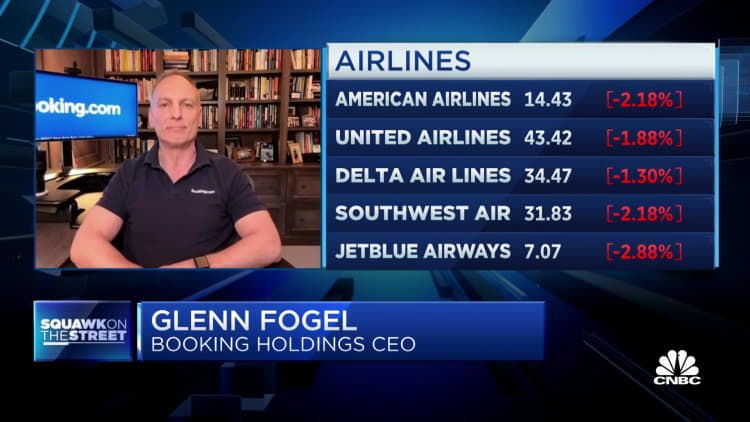

The price of flying isn’t showing signs of decline either. Airline fares were up 17.7% year-over-year in March, according to the most recent U.S. Bureau of Labor Statistics data, even as some other consumer prices cooled.

“[Consumers] have gone three years without having the experiences they want, including last summer,” Delta Airlines CEO Ed Bastian said on “Squawk Box” earlier this week. “If you think about last summer, we were still in a position where people were having to test to get back into the country and other places, and there was a lot of uncertainty around Covid – we’re through all that I think.”

Even as airline stocks took a hit on the higher costs they have been facing on fuel and labor, during Delta’s earnings call with analysts on April 13, company president Glen Hauenstein said the airline was seeing “record advance bookings for the summer,” with March advance cash bookings up nearly 20% compared to 2019 levels.

Bastian said that while domestic flights are doing well, “international is clearly the place where people are trying to get back their experiences that they lost over the last several years.”

People aren’t pulling back from travel spending

Travelers walk toward gates at LaGuardia airport in New York City, April 6, 2023.

Eduardo Munoz | Reuters

Expectations of continued consumer spending have been common among travel-industry companies in recent quarters, despite companies and executives in nearly every other sector waving warning signs that people may be cutting back.

Amazon CEO Andy Jassy said last week on “Squawk Box” that consumers are being more “deal conscious” as they try to save money. “Consumers are spending, but they’re just much more careful about what they’re spending on and we see a lot of trading down in price point,” he said.

CNBC’s recent Financial Confidence Survey, conducted in partnership with Momentive, found most Americans are living paycheck to paycheck. Some 70% of Americans admit to being stressed about their personal finances these days and a majority — 52% — of U.S. adults said their financial stress has increased since before the Covid-19 pandemic began in March 2020, according to the survey.

Fogel noted that amid consumer concerns, recent issues like instability in the banking sector “can cause people to feel concerned about what they are going to spend or not.”

However, he said that “in the long run, travel is going to continue to expand better than GDP.”

Bastian said that from his perspective, consumers are “shifting out of certain markets or shifting out of of goods and moving into the service world.”

“We’re in a multi-year recovery from the pandemic that’s going to be well above anything anyone expects,” Bastian said.